The ALP Team built an anomaly detection service for all asset classes for identification of early credit warning signals

Problem Statement

- Sudden market volatility, credit downgrade and litigation and reputational risk of bank’s counterparties lead to hefty economic losses, fines from regulators and reputational loss

- The Technology Problem: Translation from a growing volume of insightful data to knowledge was linear, constrained by traditional systems and manual effort

- Traditional Data warehousing storage and DEV OPS solutions cannot cope with the complexity and volume of data

Solution Overview

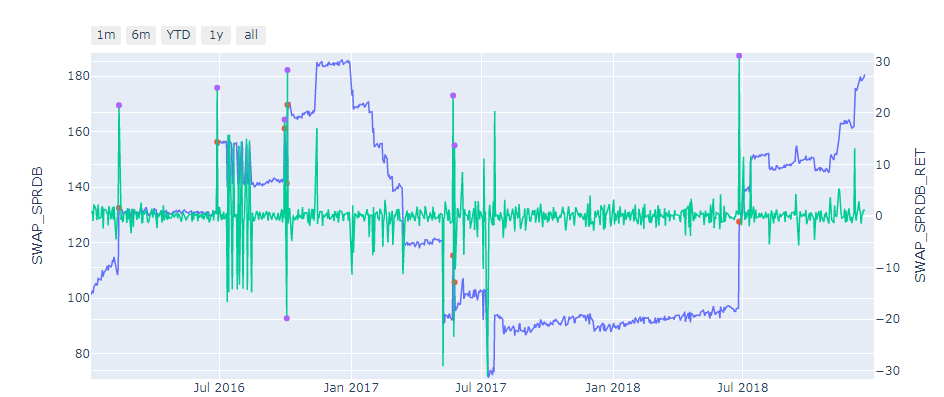

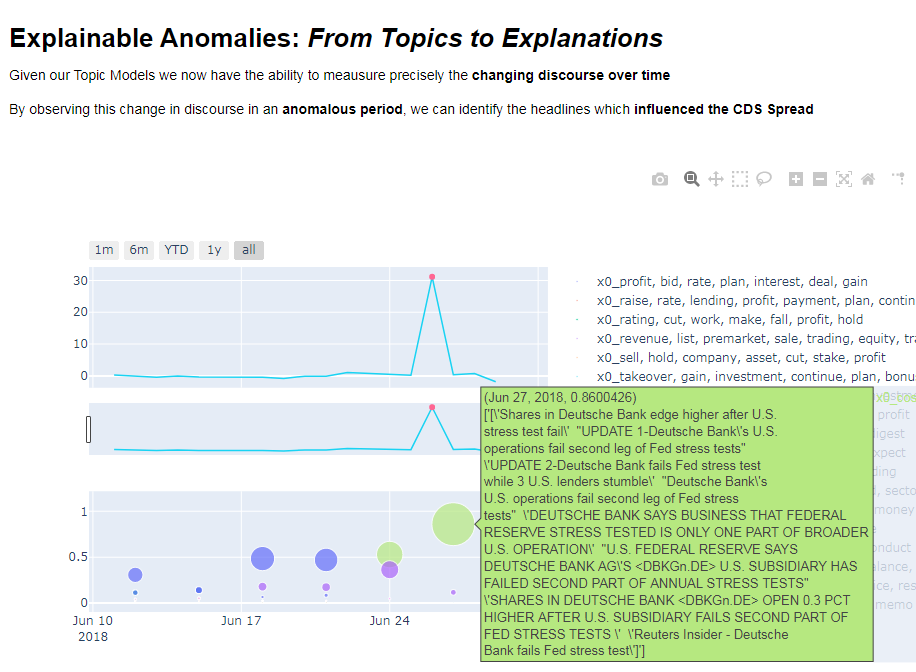

- An Anomaly detection service for all asset classes in the Deutsche Bank portfolio

- A Deutsche Bank-wide Natural Language Processing Engine and Service to digest relevant news, market commentary, internal research and ESG and Sustainability data

- A reusable and persistent store of insights such as sentiment, topics, anomalies, reputational risk scores, sustainability and ESG scores on scalable databases such as Data Lake on Azure Cloud

- A Machine Learning + Natural Language Processing + Data OPS + Cloud platform that was comparatively cheaper, more scalable and improved with the increase in data volume

Significant Benefits for Deutsche Bank:

- Potential to increase revenue as better anomaly explanation and an early warning signals-based system push up revenue on banking and trading books

- Minimization of reputational risk and regulatory penalties

- Leadership in using substantiality and ESG scores