Background and Objectives

- Notes can be vanilla or structured, unsecured or collateralised

- Transition approach depends on the prospectus and term sheet, and can be agreed upon through:

- Bilateral amendment

- Public consent solicitation

- Independent Adviser

ALP, with its experience in all types of notes, acted as an independent adviser or solicitor to the transition

Approach

Mortgage Portfolio IBOR Transition – Considerations

- Demonstrating that customers are fairly treated

- Minimal economic value transfer on transition

- Ability to explain the transition process to the client

- Operational Complexity for portfolio holder

- Legal consideration of whether the lender has the legal right to change the benchmark

ALP Analytics

- Selection of ARR and Compounding Method

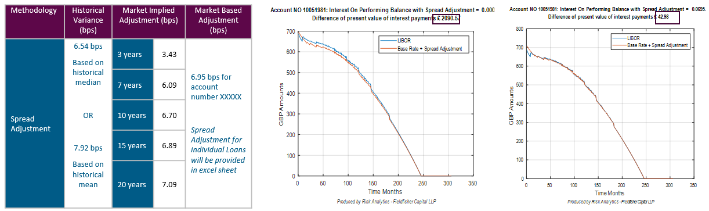

- Spread Adjustment Calculation for Loan and at Mortgage Pool Level minimizing pre- and post-transition value transfer

- Loan level SA based on current market levels of ARR and LIBOR basis

- Portfolio Level spread adjustment or a new SVR based on either the current market level or historical variance

- SVR for multiple mortgage pools

- Assist in communication with FCA and Interested Parties on the chosen methodology and its economic impact at the loan and portfolio level

ALP Risk Analytics Engine Workflow

Spread Adjustment Calculation for Mortgages

Results

- Successfully supported the client in transitioning a GBP 20 million FRN portfolio from LIBOR to SONIA. Rating analysis and hedging advise ensured that the transition did not affect the ratings of current FRNs.